If traveling was free, you would rarely see some of your friends around. The most interesting thing about traveling is you are able to meet different people and experience different cultures at the same time.

Everyone would love to travel. Just like anybody, including myself, you would want to explore a new environment. A place different from what you are used to. But the major problem is funding.

Having a nil bank account balance does not mean that you can’t travel. You can opt for funds from the available lending institutions. But prior to that, there are things you need to put in mind.

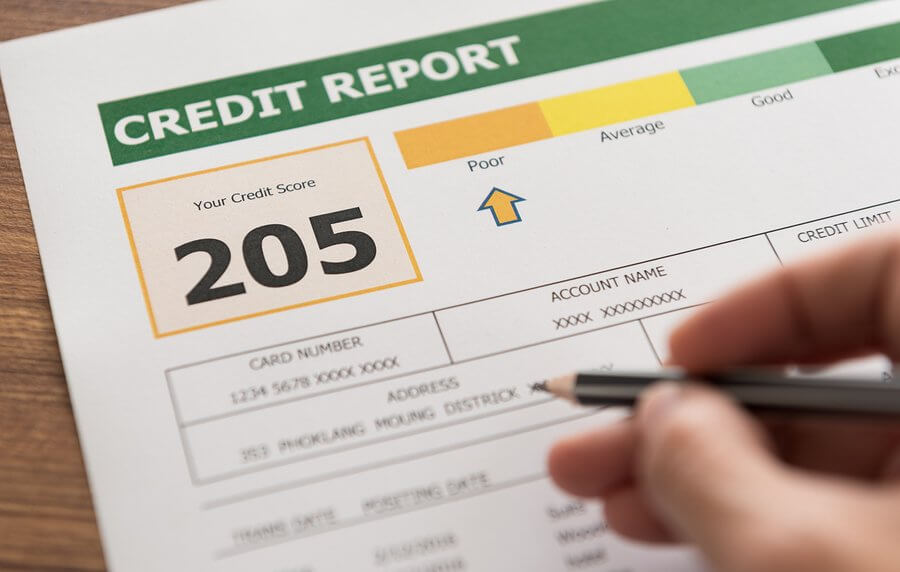

Sometimes you might consider taking the loan but you have a bad credit rating. Good news is that you can take a traveling loan to help you realize your short term goals.

I know you may be asking, is this a good option? It may seem absurd to take a vacation loan, especially when you have a bad credit rating. Vacation loans are personal loans like any other, only that they fund your holiday.

The big question is, is it a good idea to take a vacation loan for bad credit? Before you can take a vacation loan, here is what you need to know.

1. Vacation Loans for Bad Credit Require No Guarantor

You may know that other loans like credit loans require you to have a guarantor. You will need a guarantor’s signature so that your loan is approved. Vacation loans for bad credit, in this case, don’t require a guarantor.

It’s merely a personal loan only that it is for traveling escapades. In most cases, loans for bad credit don’t require you to have someone else’s signature for approval. The same applies to vacation loans.

When taking a vacation loan for bad credit, all you need is your personal information and wait for the approval.

2. No Credit Checks

When it comes to vacation loans for bad credit, your credit history is almost irrelevant. The finance company will not dig into your credit rating. Isn’t this the best thing about vacation loans for bad credit?

The finance company will only check on your ability to repay the loan. If you have a poor credit rating, then vacation loans for bad credit may be your only solution. The financier is only concerned about your future and the ability to repay your debt.

Therefore don’t be afraid to approach a vacation loan lending institution because you have a bad previous loan record.

3. High Approval Rates

The fact that credit checks are not carried out means that the chances of approval are high. Additionally, there are few requirements needed. This means the selection criteria is limited.

It’s for this reason that you are likely to attend that vacation destination of your dream this summer.

Unlike conventional loans, vacation loans for bad credit take minimal time for approval. You will get your vacation loan in the shortest time possible and hit the road.

4. Don’t Borrow More Than You Need

The fact that your credit history is irrelevant doesn’t mean you should go about borrowing huge sums.

First, plan on your budget, determine how much you need and then borrow. Like the famous adage, don’t bite off more than you can chew.

Having a budget will enable you to borrow responsibly. Take only the amount that you will need for your trip.

Before you even arrive at the sum of money to borrow, evaluate your capability to repay that loan. In simpler terms, borrow an amount that you need and which you’ll have the ability to repay.

5. Low-Interest Rates

Vacation loans for bad credit also have low-interest rates. The amount that you’ll repay will be much lower than in a conventional loan. Different finance companies offer varying interest rates on their loans for bad credit.

You can consider loans from Bonsai Finance as they have reasonable interest rates and take a short approval period.

Check out the interest rates before you can apply for a vacation loan for bad credit. The reason for this is because some financier may take advantage of the no credit history to charge hefty interests.

Choose a finance company that will provide the best interest rates and reasonable repayment intervals.

6. The Necessity of the Vacation Loan

The deal may be too sweet at some point. It may seem tempting to borrow a travel loan for bad credit since they are readily available. However, ensure that you borrow only when you need the loan.

Do you need a vacation loan? Have financial discipline and borrow only vacation loans when you are really after taking a vacation.

7. Ability to Repay

Before you can borrow the vacation loan, ensure that you can repay the loan and on time as well. Don’t be quick to take a loan that you will be unable to repay. Evaluate yourself and your financial situation before going ahead.

Before you can apply for the vacation loan for bad credit, ensure that you are capable of repaying. Repaying your vacation loan on time also boosts your credit rating.

When you repay your loan, your credit rating improves and increases your qualification chances for future loans.

Wrap Up

You need to be very careful and financially disciplined before you can take any step. If you are considering the vacation loan for bad credit, tell your family about it. Ask for guidance and advice where you don’t understand.

Ensure that you clearly understand the terms and conditions before you can apply for the loan. Before you put your signature, go through the terms and conditions given by the finance company.

Take the vacation loan for bad credit only to cater to the essential needs. Above all, ensure that you spend the loan wisely.

Visit our blog for more information on traveling tips that will earn you the perfect vacation.